Categories

Real Estate Tips, Seattle Homebuying, Mortgage & Financing, First-Time HomebuyersPublished August 14, 2025

Mortgage Basics in Seattle: A First-Time Buyer’s Guide

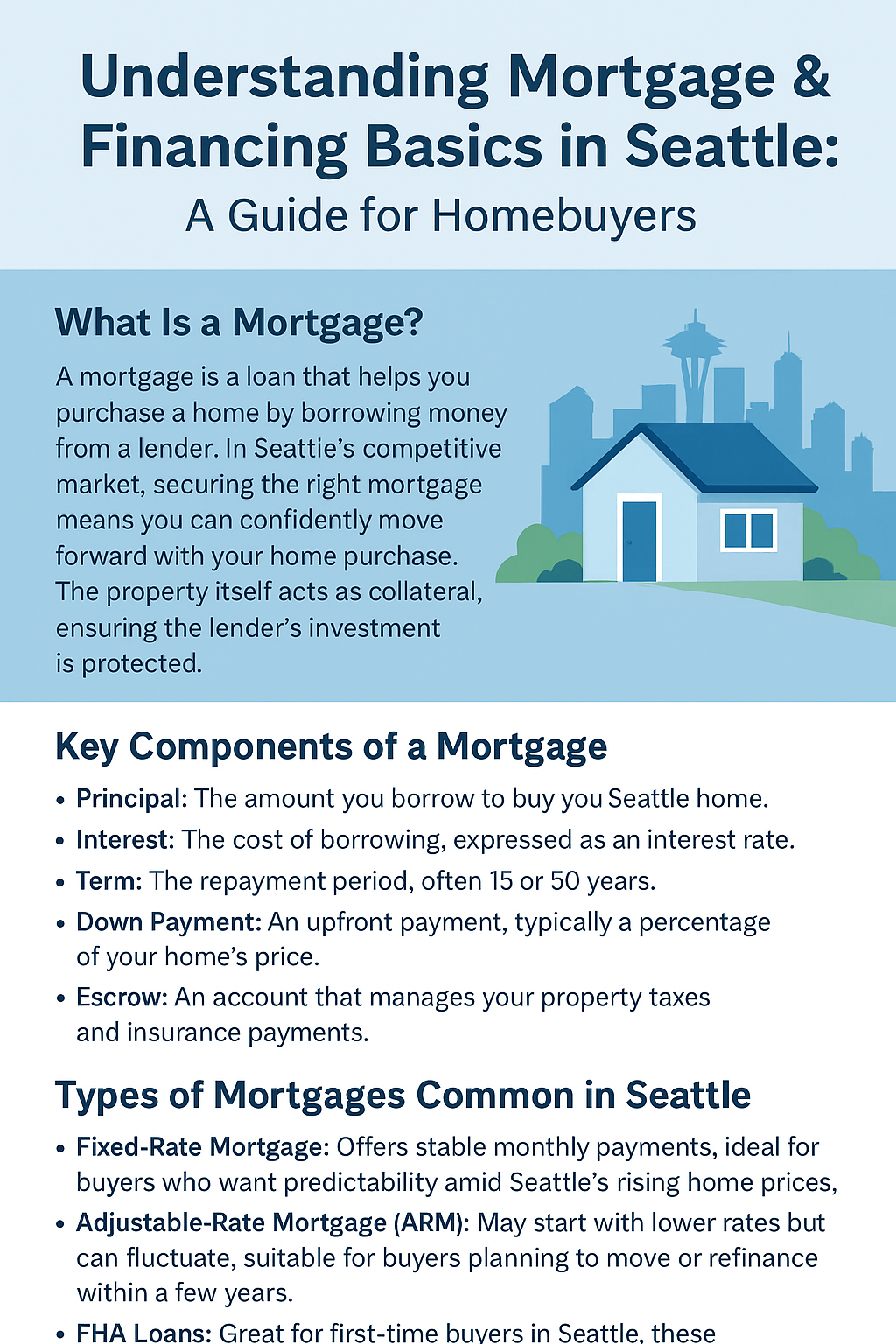

Understanding Mortgage & Financing Basics in Seattle: A Guide for Homebuyers

Seattle’s vibrant real estate market offers exciting opportunities for homebuyers, but navigating mortgage and financing options can feel overwhelming. Whether you’re drawn to the city’s dynamic neighborhoods, stunning waterfront views, or thriving job market, understanding the fundamentals of mortgages is key to making your dream home a reality in the Emerald City.

What Is a Mortgage?

A mortgage is a loan that helps you purchase a home by borrowing money from a lender. In Seattle’s competitive market, securing the right mortgage means you can confidently move forward with your home purchase. The property itself acts as collateral, ensuring the lender’s investment is protected.

Key Components of a Mortgage

- Principal: The amount you borrow to buy your Seattle home.

- Interest: The cost of borrowing, expressed as an interest rate.

- Term: The repayment period, often 15 or 30 years.

- Down Payment: An upfront payment, typically a percentage of your home’s price.

- Escrow: An account that manages your property taxes and insurance payments.

Types of Mortgages Common in Seattle

- Fixed-Rate Mortgage: Offers stable monthly payments, ideal for buyers who want predictability amid Seattle’s rising home prices.

- Adjustable-Rate Mortgage (ARM): May start with lower rates but can fluctuate, suitable for buyers planning to move or refinance within a few years.

- FHA Loans: Great for first-time buyers in Seattle, these government-backed loans often require lower down payments.

- VA Loans: Available to veterans and active military personnel, offering competitive terms and often no down payment.

Financing Tips for Seattle Homebuyers

- Know Your Credit Score: Seattle lenders look closely at credit scores to offer the best rates.

- Get Pre-Approved: In Seattle’s fast-paced market, pre-approval strengthens your offer and helps you act quickly.

- Budget for Local Costs: Remember to include Seattle’s property taxes, homeowners insurance, and potential HOA fees.

- Partner with a Local Expert: Working with a Seattle-based realtor, like the Homes on the Sound team, ensures you get tailored advice and access to trusted lenders familiar with the local market.

Final Thoughts

Buying a home in Seattle is an exciting journey, and understanding mortgage basics is your first step toward success. With the right knowledge and support, you can confidently navigate financing options and secure a home that fits your lifestyle and budget.

Ready to explore Seattle’s real estate market? Contact David Berg and the Homes on the Sound team at david.berg@homesonthesound.com or visit https://homesonthesound.com. We’re here to help you find the perfect home and financing solution in Seattle!